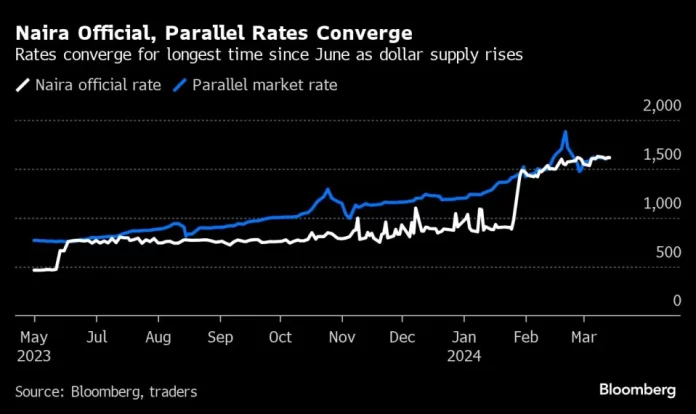

The official and parallel-market exchange rates for the naira have largely converged in recent days as capital inflows surged, leading Goldman Sachs Group Inc. to predict the currency will strengthen over coming months.

The naira was fixed at 1,615 per dollar on the official market on Wednesday, according to Lagos-based FMDQ, which tracks the data. The official rate has been within 3% either side of the parallel-market rate since last week, compared with a spread of more than 30% in January, before the central bank introduced measures to improve dollar liquidity. The parallel-market rate was 1,610 on Thursday.

The current convergence in the two rates is the longest streak since the nation initiated foreign exchange market reforms in June.

Africa’s most populous nation first implemented measures in June to attract inflows, effectively devaluing the naira and pushing the official and black-market rates closer together for a brief period. It allowed the local currency to weaken again in January. A jumbo interest rate hike last month helped stabilize the currency.

The measures are starting to pay off, with overseas remittances rising more than fourfold to $1.3 billion in February from a month earlier, according to Hakama Sidi Ali, a spokeswoman for the central bank. Foreign-investor portfolio asset purchases exceeded $1 billion in February, bringing total inflows this year to at least $2.3 billion, compared with $3.9 billion for the whole of 2023, Ali said last week.

If the the central bank continues to raise interest rates, the naira could strengthen from here, according to Goldman Sachs Group Inc.

“When it comes to the metrics of value, carry and real rates, Nigeria’s naira now screens as one of the more attractive frontier currencies, with recent rate increases,” Goldman Sachs analysts including Kamakshya Trivedi and Caesar Maasry wrote in a note. They see the naira appreciating to 1,200 per dollar in the next 12 months.

Source: Bloomberg Businessweek